The Coir segment topped the chart in the 1980s and the PU foam segment is currently dominating the modern mattress industry. However, there is likely to be more demand for the spring mattress segment in the near future.

The Indian mattress industry has always come up with new types of mattresses after analyzing the needs of the customers. While the 1950s and 60s were dominated by cotton and coir mattresses, the 1970s witnessed the introduction of polyurethane (PU) foam in India. Then came the spring mattresses. The growth and dominance of each mattress segment (by material type) have varied at different stages, giving us an idea about the consumers’ buying preferences and lifestyle changes at different eras.

Different types of mattresses have contributed tremendously towards the growth of the Indian mattress industry as they cater to the varied needs of consumers. In the initial stages of the mattress industry, a limited number of consumers had the purchasing power to buy a cotton mattress but these mattresses shaping up unevenly after regular use caused discomfort. To address these issues, new types of mattresses were launched. The overall Indian mattress market can be classified into the cotton mattress market and the modern mattress market. According to a Technopak analysis report, “a major share of cotton mattresses is used by people from rural and semi-urban areas, because of their low prices and these are manufactured only by unbranded players. Cotton mattresses are generally priced below Rs 1,500 for a single mattress. On the other hand, a major share of the modern mattress market is primarily used in metro, mini-metro, and tier-I cities and these are manufactured by both branded and unbranded players. Modern mattress market operates across price segments, with branded mattress prices ranging from Rs 5,000 to Rs 75,000+, whereas unbranded mattress prices ranging from Rs 2,000 to Rs 5,000.”

Based on material type, the Indian modern mattress market can be segmented into PU Foam, spring, and rubberized coir mattresses. They have their own set of merits and demerits and each one of these segments has competed with each other with each one commanding a dominating market share at different periods of the mattress industry.

Key market players who have launched their products with either of these mattress materials are trying to complement their products with the advantages of another material type. For instance, PU foam manufacturers are increasingly resorting to eco-friendly raw materials to make their PU foam products more eco-friendly, to lure more environmentally conscious consumers who would prefer coir mattresses for their eco-friendly raw materials. Meanwhile, coir manufacturers are using some foam layers to provide more cushioning and ensure that the rubberised coir does not prick the sleeper.

While the 1950s and 60s were dominated by cotton and coir mattresses, 1970s witnessed the introduction of polyurethane (PU) foam in India.

With this article, we aim to analyze the past, present and future performance of coir, spring and polyurethane (PU) foam mattresses in India. While vaguely analyzing the market share of different types of mattress segments, we got further intrigued to explore further the journey of these three mattress segments in the 1980s, 2000s and 2020s. Let’s take a look at the market performance of various mattress types at different times.

1980s: Coir tops the chart

As the Indian economy got into the phase of industrialization and urbanization in the 1960s, the demand for modern beds and mattresses increased. This led to the emergence of a few small-scale mattress manufacturers, who supplied mattresses primarily to the urban middle class. Popular brands that are now synonymous with mattresses came into existence in the 60s.

These early manufacturers produced cotton and coir mattresses, which were affordable and durable. Coir is the first evolution that happened in the Indian mattress

industry. The coir segment dominated the overall mattress market in India and its dominance continued through the 1980s. Coir mattresses came as the best alternative available for Indian consumers, who back then, did not have enough purchasing power or awareness about the benefits of sleep.

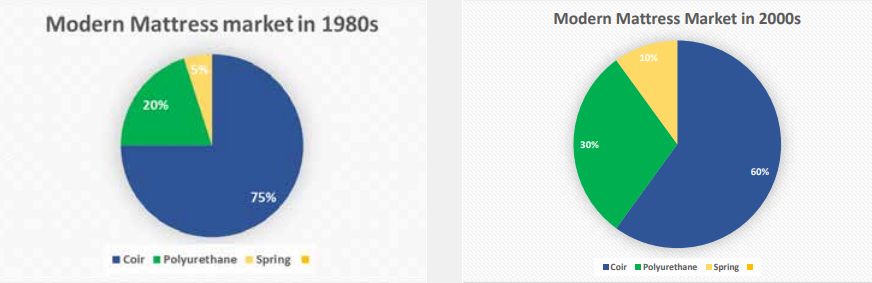

According to Indian Sleep Product Federation, in the 1980s, the coir segment dominated the domestic mattress industry with a 75 percent share, while the polyurethane (PU) foam segment owned a 20 percent share and the spring segment had a limited presence with only a 5 percent share in the overall modern mattress market. (Refer image 1)

Some of the reasons favouring the dominance of the coir segment in India could be attributed to coir being an indigenous product that was produced locally through dried coconut comprised of long fibre, short fibre and dust. Coir mattresses were relatively more accessible and affordable compared to other types of mattresses that had to be imported from other countries. Moreover, coir mattresses were also seen as a cultural preference in certain regions of India, particularly in the southern states of India where coir production was a traditional industry. This regional affinity was a strong reason that contributed to the demand for coir mattresses. The Indian government promoted the use of coir products, including mattresses, as part of its rural development initiatives, which further increased the demand for coir mattresses in different parts of the country. Meanwhile, PU foam had also entered the Indian mattress industry but it still commanded a lesser share compared to the coir segment.

Based on material type, Indian modern mattress market can be segmented into PU Foam, spring, and rubberized coir mattresses.

2000s: the growth stage of Polyurethane (PU) foam and spring segment

As the Indian economy began to liberalize in the 1990s, foreign players entered the market, bringing with them new technologies and materials. PU was imported from Germany, unlike rubberized coir which was manufactured indigenously. PU foam attracted attention for its technology, comfort and support and it had emerged as a good alternative. As people started importing PU mattresses, they were levied import duties and other taxes. In the 2000s, the Indian mattress industry saw significant growth, with the entry of several new players and the introduction of modern materials such as memory foam and latex.

A demographic difference was witnessed during this stage, wherein, the rural market demanded more cotton and coir mattresses, whereas, the high-income groups looked forward to buying spring and memory foam mattresses. According to ISPF, the modern mattress market in the 2000s witnessed the market share of the coir segment shrinking, while the PU foam segment and spring segment were expanding their presence in the mattress market. While the coir segment still dominated the modern mattress market with a 60 percent share, the PU foam and spring segments recorded 30 percent and 10 percent, respectively, in the overall mattress market.

PU foam started gaining popularity because of the cushioning, durability and flexibility it offered compared to traditional mattress materials. The affordability and availability of PU foam made it a popular choice among mattress manufacturers. Additionally, PU foam mattress manufacturers tried out many innovative technologies that helped them maintain a cost advantage while offering a variety of products at different price ranges catering to the needs of the consumers.

2020s: PU foam leads leaving coir behind

Currently, PU foam continues to dominate the Indian mattress industry. Its ability to conform to body contours, provide pressure relief and support different sleep positions has made it a preferred choice for many consumers. With the pandemic acting as a catalyst, people are now more health-conscious and have started prioritizing sleep to maintain their health. PU foam mattresses are available in a wide range of comfort levels to accommodate individual preferences. With the expanding omnichannel presence of various PU foam mattress companies, the market for PU foam mattresses is growing bigger each year.

According to ISPF, the modern mattress market is currently dominated by PU foam commanding 55 percent of the market. Meanwhile, the coir and spring segments hold a share of 30 percent and 15 percent respectively.

Another observation from Technopak Analysis mentions, “As of Fiscal 2023, PU Foam mattresses constituted approximately 50 percent (Rs 8,450 Crore) of the Indian modern mattress market by value, whereas spring and rubberized coir mattresses constituted approximately 22 percent (Rs 3,720 Crore) and approximately 28 percent (Rs 4,730 Crore) of the market respectively. In terms of volume, the market size of PU Foam, spring and rubberized coir mattresses were 10 million units, 2.5 million units and 6.1 million units respectively as of Fiscal 2023.”

PU foam manufacturers are increasingly shifting their focus on enhancing the properties of PU foam, such as improving breathability and temperature regulation. Manufacturers are also working on innovations like gel-infused or open-cell PU foam that would address issues of heat retention and provide a cooler sleeping surface.

Road Ahead

Going by the numbers mentioned above, one can decipher that each mattress segment has maintained its dominance at different phases. However, consumer preferences keep changing over a period owing to various business and circumstantial factors. One more observation that can be noticed from the above numbers is the steady efforts made by the spring mattress segment to have its presence in the modern mattress market.

“Earlier, the coir used to dominate the market but the recent trend shows the foam mattresses are dominating compared to the other two i.e spring and coir. The spring segment has also grown up considerably because lot of avenues for customers to move out of India enjoying the hospitality at different countries where the spring mattress is more used in the hospitality industry, especially the hotels. So, they come back and search for a range of spring mattresses,” says Ravi Prasad, Chief Product Officer at Kurlon Enterprise Limited.

Even a Research and Markets report points out that “Indian consumers usually prefer a coir mattress or a foam mattress but the demand is now changing towards spring mattresses. Globally, the majority of sales is in the spring mattress segment while in India the spring mattress category is at a nascent stage.

A vague analysis of all three types of mattresses will make us realize that each type of mattress has its own set, of merits and demerits. Coir mattresses are eco-friendly and considered healthy but they tend to sag very soon, resulting in a low replacement cycle. PU foam mattresses offer better comfort and cushioning while being cost-effective but a lot of chemicals go into making them for which a growing number of health-conscious consumers may refrain from demanding more of PU foam mattresses. Spring mattresses may offer more comfort but they can wear out faster, if not maintained properly.

Market players in these respective segments are trying to work on the weaknesses of their products to ensure that they match up to the advantages offered by their competing segments. There is a remarkable shift in the consumer mindset these days with a greater number of people showing inclination towards sustainability, recyclability and reusability. “Now people talk about sustainability and recycling. The focus has slowly come on products which are sustainable, recyclable or reusable and the importance of rubberised coir has slowly started growing up compared to others. So, the focus of every company that sells mattresses will be on the sustainability factor to see that every product used should be natural and sustainable. So, I believe that in days to come, the coir mattresses will regain their importance again. Its awareness is very high in Western countries, not only in India. So, now people are searching for rubberised coir mattresses, especially South Asian countries have started exporting this and this trend will again come back to India and regain importance,” explains Ravi Prasad of Kurlon Enterprise Limited.

In a nutshell, the coir segment dominated the past and the present belongs to the PU foam segment. Meanwhile, the spring segment is still at a nascent stage in India but is likely to grow in the near future. What initiatives various market players in these three segments will take, will be an interesting development to watch out for.