In the fast-changing business environment, retailers are finding it tough to take on competition. Though the market is opening up, with the awareness and spending nature of the upper middle class, still the retailers are feeling the heat of competition and the dry season.

Consumer-driven factors such as increasing population, rising urbanization, and improvement in institutional infrastructure (housing, hospitality and healthcare segment) are key growth drivers for the mattress market. However, the high share of branded players in the mattress market can be attributed to the efforts and investments made by mattress players to increase consumer awareness about quality mattresses through the development of retail infrastructure and marketing activities.

The mattress industry has transitioned over the last few years from a largely unbranded market to a branded market. The branded market comprising large, mid-size and smaller manufacturers constitutes around 34% of the market, with around 20-25 players spread across the geographies. The branded mattress market is expected to grow at a CAGR of ~13% over the next 5 years to constitute 37.5% of the market by 2022. The implementation of GST has narrowed the price gap between branded and unbranded players leading to an increase in opportunity for branded mattress players.

Industry Report

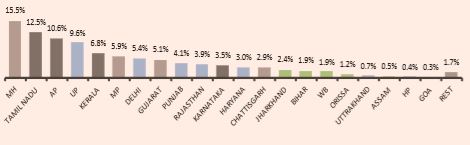

According to an ISPF study on Modern Mattress Retail Market Dynamics, it is estimated that for every one lakh people, there are 11 mattress-stocking outlets resulting in almost 40,000 such outlets in urban India. Nearly half of them are furniture stores. One cannot ignore the presence of appliance stores (with preponderance in the South Zone) and furnishing stores as well. Towns with a population of more than 1 lakh account for 66% of the mattress stocking outlets. The average footfall at these retail outlets is significantly higher than the average mattress sale. Retail players will have to figure out innovative ways of increasing the conversion of walk-ins.

Based on the distribution channel, the branded mattress market is dominated by distributor/dealer networks constituting ~88% of the market followed by Exclusive Business Outlet (EBOs) of brand and online platforms. Going forward, the share of online is expected to increase owing to the rising youth population and the increasing reach of online platforms.

Dry Season

In the fast-changing business environment, retailers are finding it tough to take on competition.

Though the market is opening up, with the awareness and spending nature of the upper middle class, still the retailers are feeling the heat of competition and the dry season. In Bangalore alone, there are over 2200 retailers in the mattress space.

Looking at the trends and customers needs, retailers need to use different platforms and business models like social media, online sales, and year-long discount offers to get hold of the customers. Despite making efforts, mattress retailers across India do face dry season from January to May.

Facing Competition

Looking at the growth and huge opportunities in India, global mattress companies like Serta, King Koil, Emma, and many others have entered the Indian market by launching their products in the last few years. One of the leading global mattress companies launched breakthrough technology in India recently that assures better and restful sleep. With this launch, the customers will get a new range of orthopaedic series, Chiropedic series and electric adjustable beds.

To outshine competition and support customers the company has been making consistent efforts. It has brought innovative software by the name of SLEEP ID that helps in choosing the right mattress that is based on one’s body dynamics.

In such stiff competition, how can a retailer compete with large global giants and their offerings?

Material-wise Share of Mattress Sales of Retailers

To help retailers, Indian manufacturers should consider launching new products, accessories and technologies, which can attract new customers and more footfalls to help EBOs.

To address the competition, a retailer in Bangalore is promoting one of India’s leading brand’s new products ‘Posture Support Mattress’, designed to support the body posture while sleeping. It comes in three variants suited for different body types – Lean (40-60kg), Medium (50-90kg) and High Built (80-100kg). Retailers who dominate the mattress business continue to meet the expectations and needs of both new and old customers by engaging them regularly by showcasing new products and addressing their feedback appropriately.