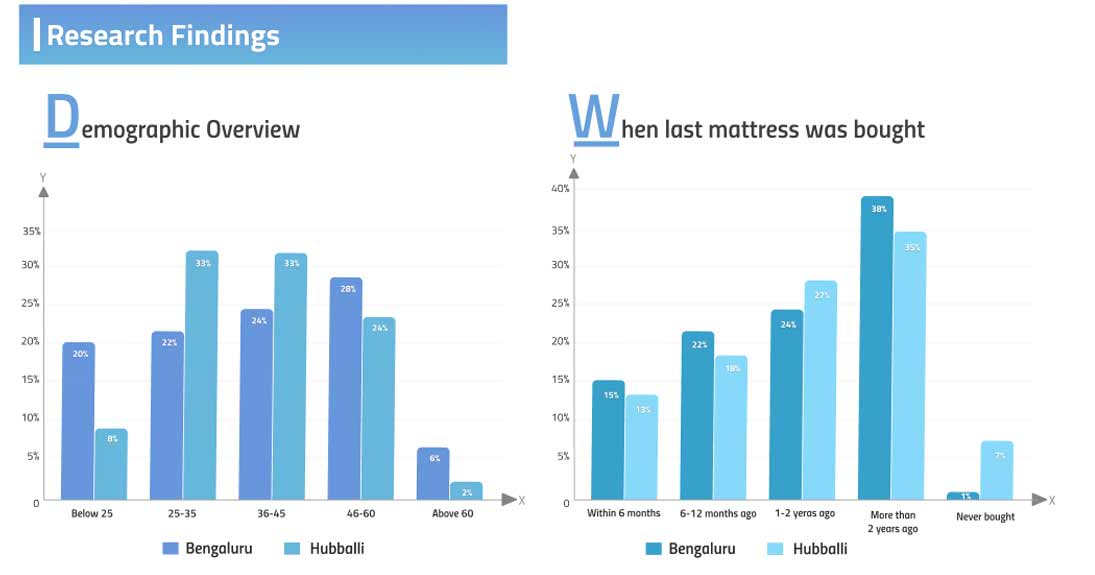

The study revealed that most consumers typically replace or buy new mattresses within a span of a few years, though the replacement cycle differs by city. In Tier 1, where awareness of branded products is higher, consumers are more likely to seek upgrades or replacements proactively, often linked with lifestyle improvement. In Tier 2, purchases are more occasional, triggered primarily by need rather than aspiration. where awareness of branded products is higher, consumers are more likely to seek upgrades or replacements proactively, often linked with lifestyle improvement. In Tier 2, purchases are more occasional, triggered primarily by need rather than aspiration.

Purchase Channels

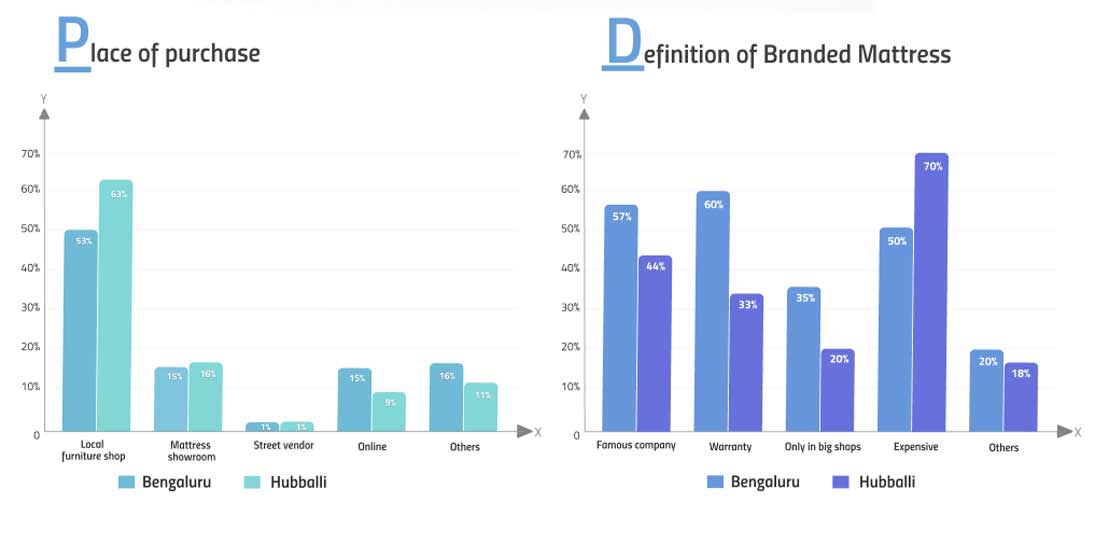

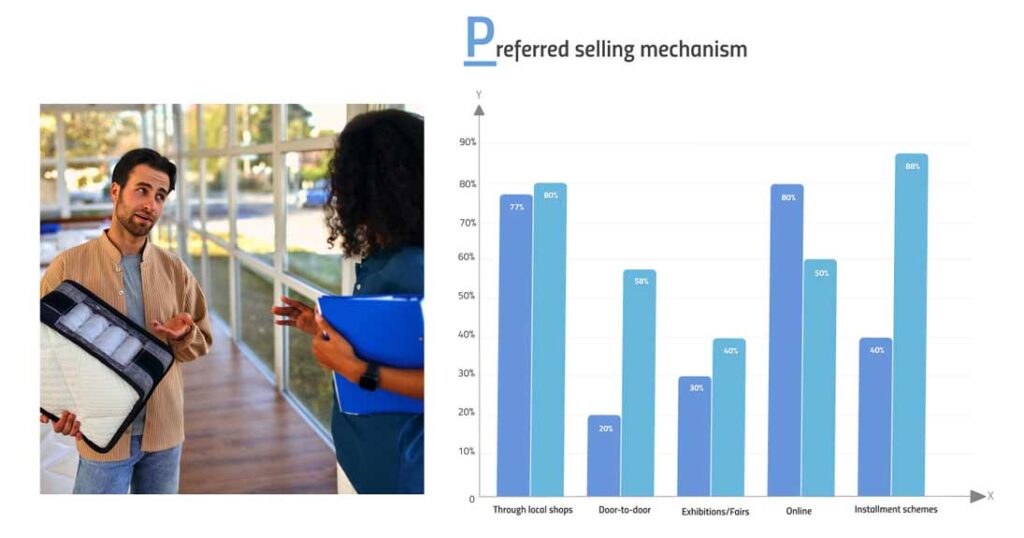

Purchase location plays an important role in consumer decisions. Bengaluru buyers lean more towards organized retail outlets and branded showrooms, reflecting greater trust in formal retail structures. Conversely, Hubballi consumers prefer local, unorganized retailers, often relying on personal relationships and trust built with neighborhood sellers. This highlights a key difference in purchase dynamics: structured versus relationship-based buying.

Key Purchase Influencing Factors

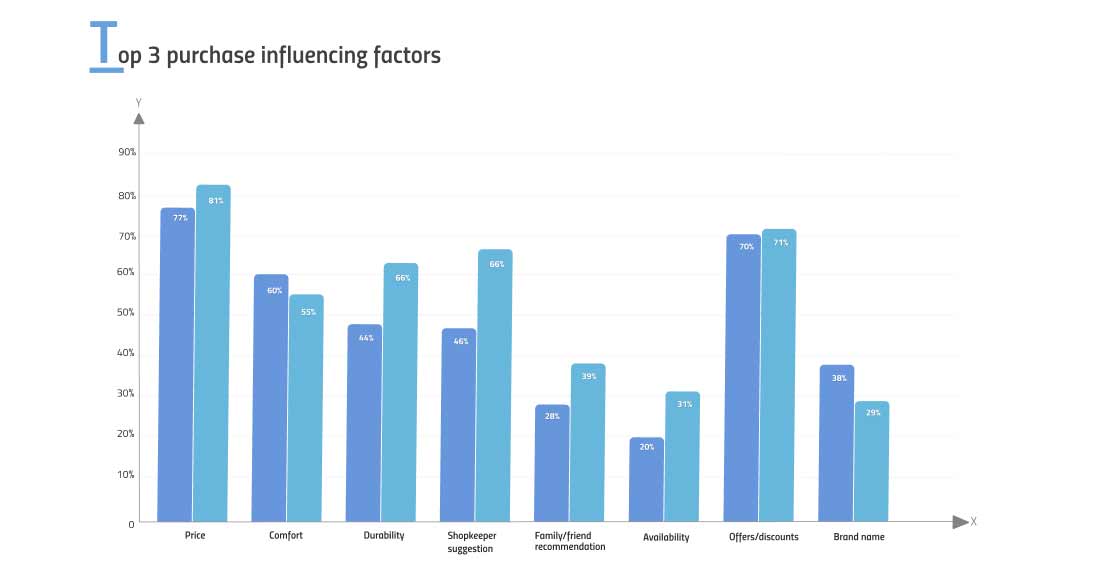

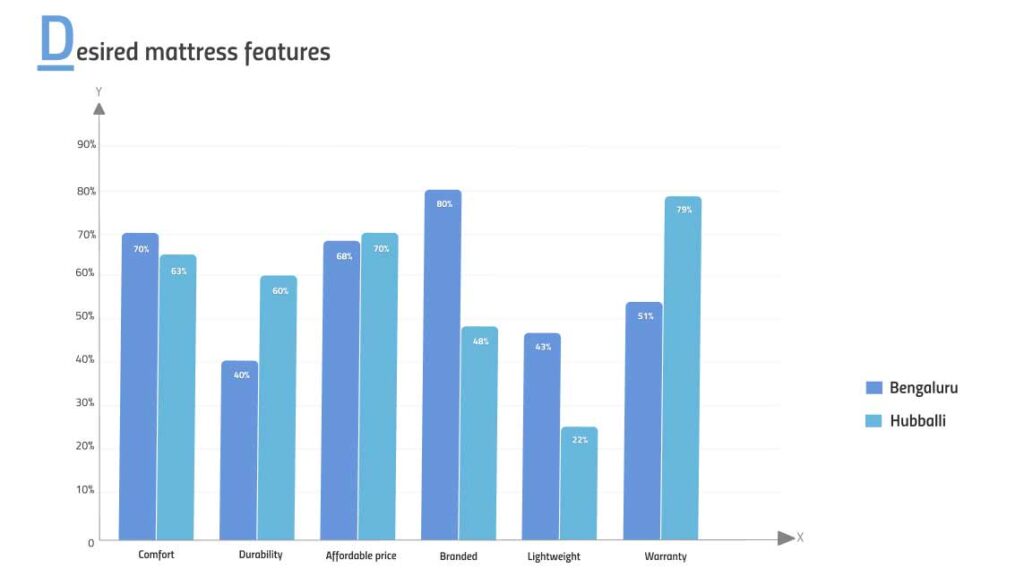

Across both markets, three broad factors emerge as decisive: price, comfort, and durability. Tier 1 consumers show higher willingness to pay a premium for branded mattresses, valuing perceived quality, warranty, and after-sales service. Tier 2 consumers, however, are highly price-sensitive and view mattresses largely as functional, with affordability being the most dominant driver.

Brand Awareness and Perception

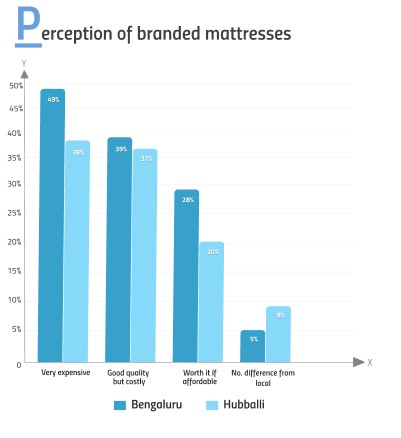

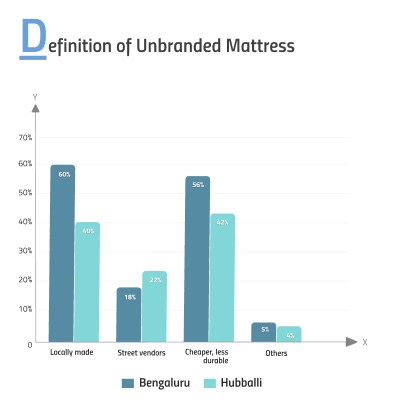

Awareness of mattress brands is significantly higher in Bengaluru than in Hubballi. In Tier 1, consumers are familiar with leading national and regional brands, whereas in Tier 2, “branded” often simply implies any mattress with labeling, packaging, or warranty contrasted with “unbranded” local products that are cheaper but lack formal guarantees. Branded mattresses are perceived as higher quality, longer lasting, and more comfortable, though often considered too expensive by Tier 2 buyers.

Future Preferences and Desired Features

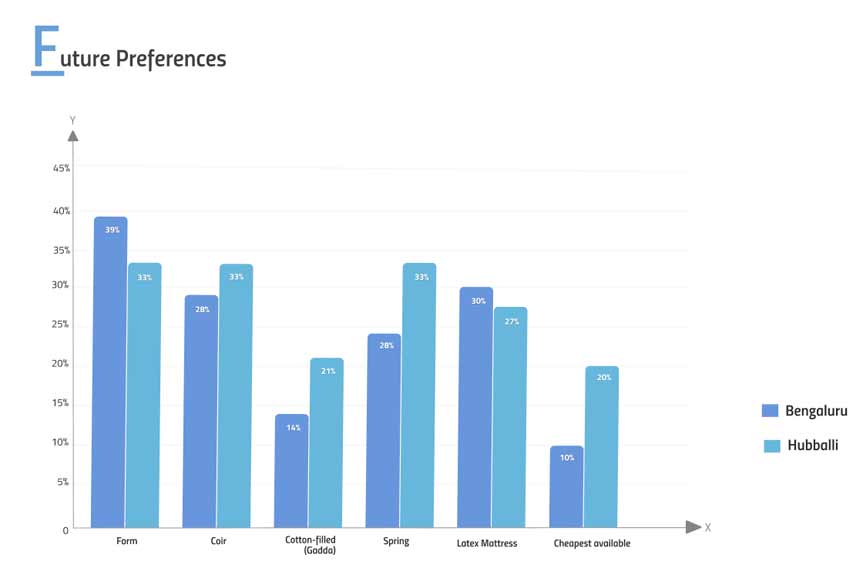

When asked about future purchases, Bengaluru consumers expressed a preference for branded options with features such as orthopedic support, durability, and attractive financing options. Hubballi buyers also desired features like comfort and durability but stressed affordability and easy availability. Both groups showed interest in flexible payment schemes such as EMI options, which can bridge the affordability gap.

Barriers to Branded Mattress Adoption

The most significant barriers are high price points, limited local availability in Tier 2, and lack of awareness of long-term benefits. Consumers in Hubballi often trust their local retailers more than distant, well-advertised brands. This indicates the need for localized outreach, distribution partnerships, and pricing strategies that resonate with semi-urban buyers.

THE BUSINESS CONTEXT

- The Indian mattress market is witnessing rapid evolution driven by increasing health awareness, urbanization, and a growing appetite for quality sleep products.

- While premium and urban segments have seen a surge in branded mattress adoption

- Large part of the market especially in Tier 1 and Tier 2 cities among lower-income households remains dominated by unorganised, local, and non-branded players.

Survey Highlights

The study concludes that a differentiated approach is essential. In Tier 1, brands should emphasize quality, innovation, and after-sales service while leveraging organized retail presence. In Tier 2, affordability, local visibility, and financing solutions must be prioritized. Entry-level branded SKUs, coupled with strong after-sales support, could drive adoption across both markets. For long-term growth, building trust at the community level and offering tangible value at competitive prices will be key.

Overall, the survey shows that while Tier 1 consumers are aspirational and brand-driven, Tier 2 consumers are practical and price-conscious. Mattress brands must balance affordability with brand value, ensuring that their products are accessible while still delivering the promise of durability and comfort. By tailoring go-to-market strategies to local realities, brands can successfully expand penetration in both urban and semi-urban markets

Research Objective

- The primary objective of this study is to understand the key factors influencing mattress purchase decisions among consumers in Tier 1 and Tier 2 cities, and to identify how brands can better penetrate and grow in this segment.

- To profile the consumer segment

- To identify the key triggers and barriers

- To explore consumer understanding and perception

- To evaluate brand awareness and consideration

- To assess product preferences

- To recommend effective strategies

Key Highlights

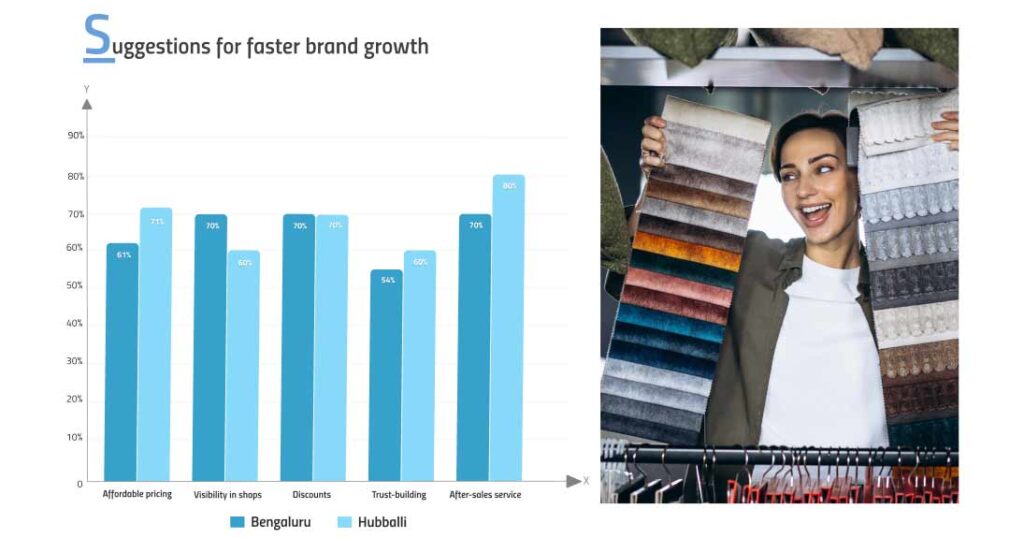

- Affordability (Bengaluru: 61%, Hubballi: 71%) and installment schemes (Bengaluru: 40%, Hubballi: 88%) are critical levers to increase adoption of branded mattresses.

- Local advertising, door-to-door outreach, and visibility in retail outlets are especially important in Hubballi.

- Major barriers include high pricing, lack of availability, and low awareness particularly in Hubballi, where 88% cite price and 30% cite lack of awareness as key hurdles.

Executive Summary

- The dominant age groups purchasing mattresses are 36–60 years in both cities, with Bengaluru showing more older consumers (46–60: 28%) and Hubballi having stronger representation in the 25–45 bracket (66%).

- Over 35% of respondents in both cities purchased their mattress more than 2 years ago, indicating a relatively slow replacement cycle. However, 13–15% are recent buyers, revealing a steady, ongoing demand.

- Notably, 7% in Hubballi have never bought a mattress, suggesting continued penetration opportunities.

Essential Insights

- Brand name influence is significantly higher in Bengaluru (38%) than in Hubballi (29%).

- Top-of-mind (TOM) brands in Bengaluru include Sleepwell (56%) and Kurlon (51%), whereas in Hubballi, Kurlon (44%) and Sleepwell (38%) lead.

- Consumers in both cities equate branded mattresses with being expensive (Bengaluru: 50%, Hubballi: 70%) and having warranties (60% and 33% respectively).

- In Hubballi, local brands and unbranded products still have a strong foothold.

Final Takeaways

- Foam and spring mattresses are most popular in both cities (Bengaluru: 39%, Hubballi: 33% each).

- A sizable portion in Hubballi (21%) still prefers cotton-filled (gadda) mattresses, indicating more traditional preferences.

- Majority of purchases fall in the ₹10,000–₹20,000 range, but Hubballi has a greater share of buyers below ₹10,000.

- Key expectations include comfort, affordability, warranty, and branded assurance.

- Bengaluru consumers value branding more (80%) compared to Hubballi (48%), while Hubballi emphasizes durability and service support.

Conclusion

While Bengaluru consumers are more brand-conscious and open to organized channels, Hubballi buyers are highly price-sensitive and driven by trust in local sellers. Brands must tailor their go-to-market strategies by focusing on affordability, local visibility, and financing. Offering entry-level branded SKUs with strong after-sales support could be a winning proposition in both markets.