Today’s urban consumers are actively prioritizing comfort, health benefits, and convenience factors that were once considered secondary to durability and price. This change

signals a broader transformation in how Indians perceive sleep and wellness, and it opens up new opportunities for mattress brands to redefine their value propositions and customer engagement strategies.

At the heart of this shift is a new generation of buyers young, digitally-savvy professionals primarily in the 26–35 age group who are becoming the dominant decision-makers in urban households. These consumers are not just looking for a place to sleep; they are looking for a sleep experience that supports their lifestyle. Whether it’s the ergonomic support of an orthopedic mattress or the enhanced comfort of cooling gel layers to combat urban heat, younger consumers are demanding features that align with their wellness goals and fast-paced routines.

This demographic is particularly influential because it represents a blend of aspiration and practicality. While comfort and innovation are high on their list, these consumers are also value-conscious. They research thoroughly, compare options online, read reviews, and often rely on digital platforms to make purchasing decisions. For them, a mattress is an investment not just in a product, but in better health, improved sleep quality, and overall well-being. This presents a unique opportunity for mattress brands to go beyond traditional selling points and embrace a more holistic, lifestyle-oriented approach to product development and marketing.

In response to this growing demand, the Indian mattress industry must pivot in three key areas: customization, logistics, and digital engagement. Customization is becoming increasingly important as consumers look for products tailored to their specific needs be it firmness levels, body support, temperature regulation, or even allergen resistance. Brands that can offer modular or made-to-order options will have a distinct advantage, especially in the premium and semi-premium segments.

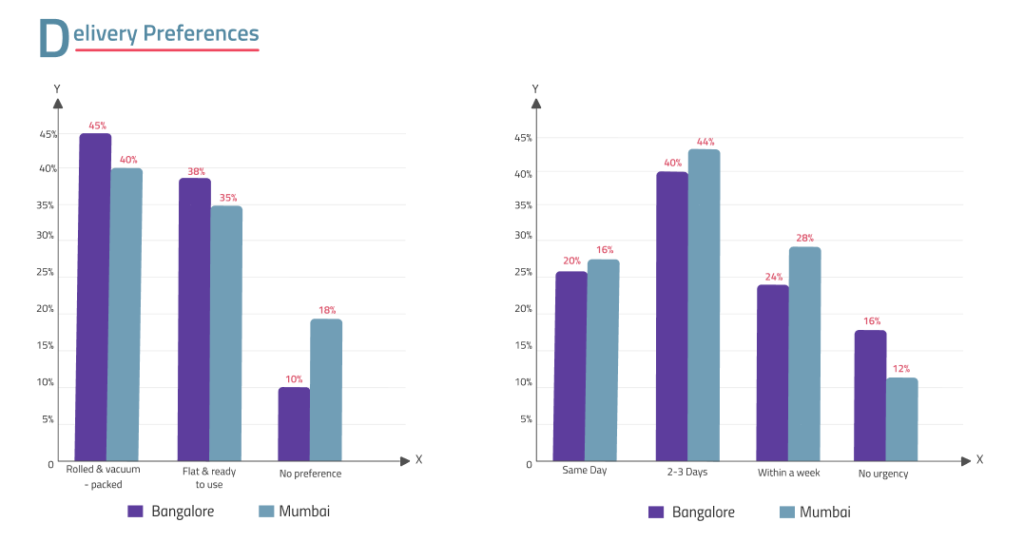

Efficient logistics and hassle-free delivery are also critical, especially in densely populated cities where convenience can often be the deciding factor in a purchase. The rise of e-commerce has raised the bar for fast, reliable, and transparent service. Mattress companies that can ensure quick delivery, easy unboxing, and smooth returns or exchanges will not only gain customer trust but also build long-term loyalty in a competitive market.

Finally, targeted digital engagement will be vital to capturing and retaining attention in a crowded online space. Consumers in this segment are highly engaged online and expect brands to meet them where they are on social media, mobile apps, and influencer channels. Educational content about sleep health, interactive product demos, user-generated reviews, and data-driven personalization will all play a role in driving conversions and brand recall.

In essence, the Indian mattress market is at a pivotal juncture. As consumers become more discerning and expectations evolve, brands must innovate and adapt to remain relevant. The future of this market lies in its ability to balance comfort with customization, and convenience with credibility. Those who can successfully navigate these shifts will not only capture a growing market share but also help redefine what a good night’s sleep means in modern India.

Research Objective

The primary objectives of this consumer research were to :

- Understand consumer demographics in Bangalore and Mumbai that influence mattress purchasing decisions.

- Identify key preferences regarding mattress features such as size, thickness, material composition, and comfort perception.

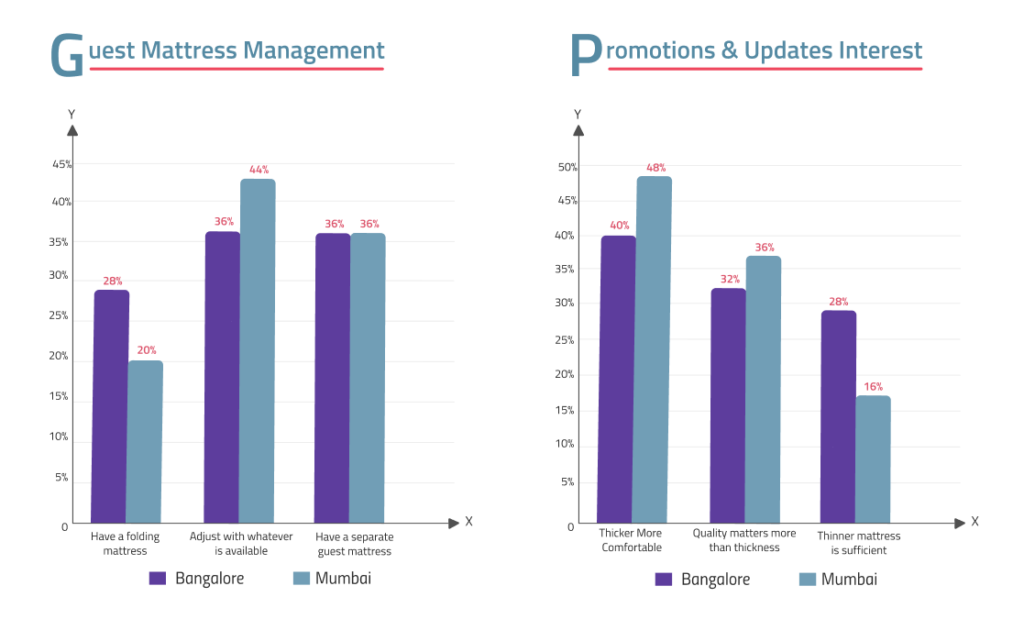

- Evaluate consumer behavior in terms of mattress replacement cycles, delivery expectations, and guest accommodation practices.

- Explore awareness and demand for advanced mattress features like orthopedic support, cooling technology, and customization.

- Assess preferred communication channels for promotions and product updates.

Research Findings

Memographic Overview

This study delves into the evolving mattress preferences of urban consumers, offering insights into their purchasing behaviors, key decision drivers, and expectations from mattress brands.

Surveys and interviews conducted across metropolitan areas, the research highlights trends in material choices, brand perception, pricing sensitivity, and the growing influence of health and lifestyle factors.

Executive Summary

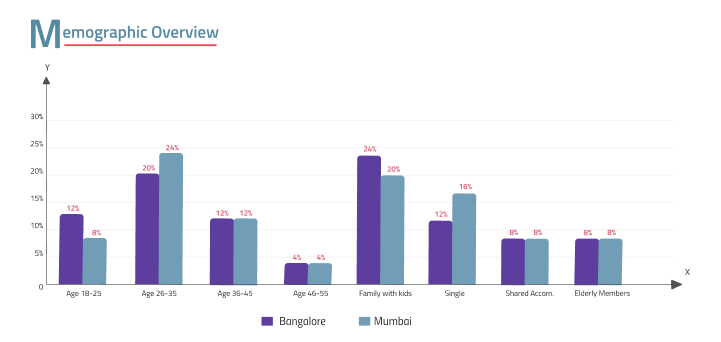

Demographics

The majority of respondents were between the ages of 26 and 35. A significant proportion in both cities belonged to nuclear families, with a notable number having children. A small but relevant percentage lived in shared accommodations or with elderly members.

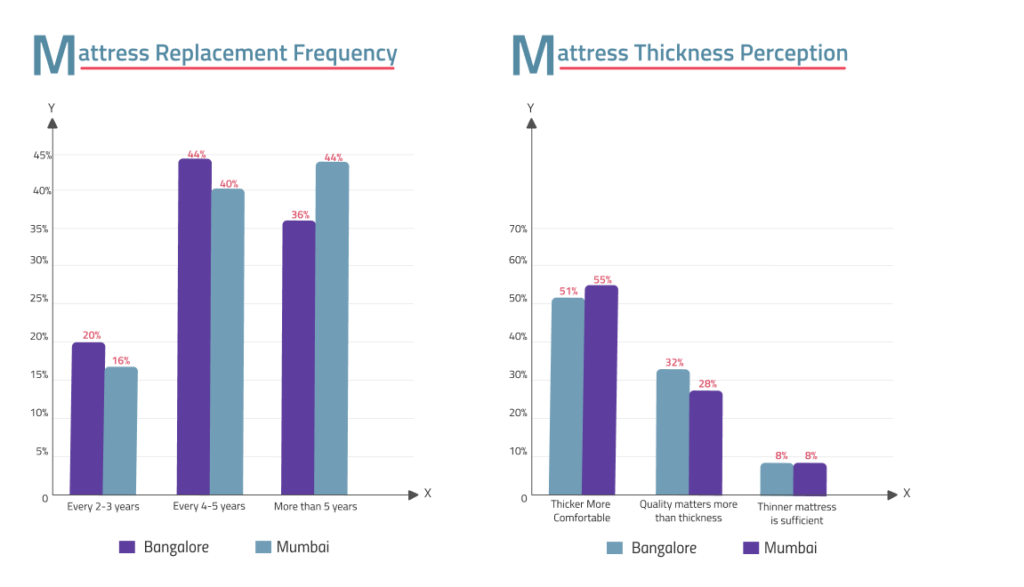

Comfort Perception

A large segment associated thicker mattresses with better comfort, although a meaningful number emphasized the importance of material quality over thickness.

Feature Preferences

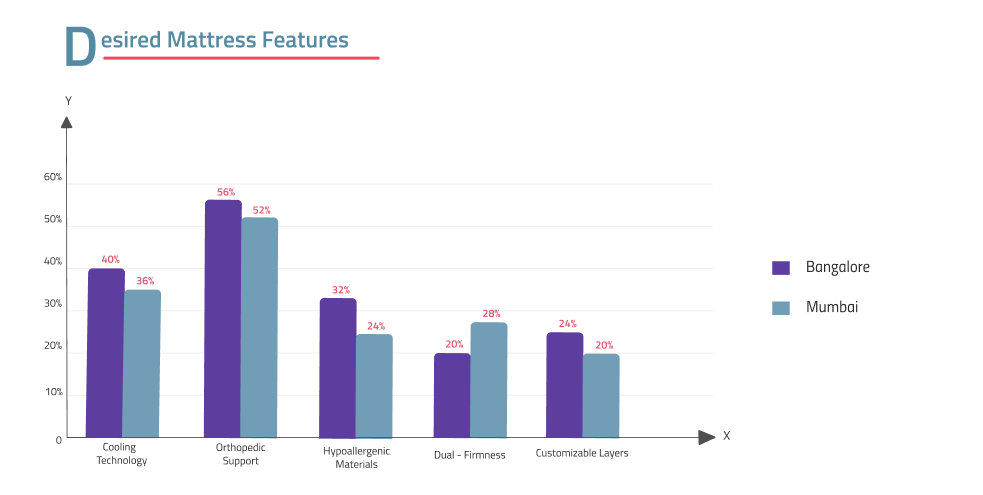

Orthopedic support was the top-rated feature in both cities. Cooling technology and hypoallergenic materials were also valued, especially in warmer and humid environments.

Mattress Replacement

Most consumers replace their mattresses every 4–5 years or after 5+ years, indicating a moderate to long lifecycle expectation.

Comfort Perception

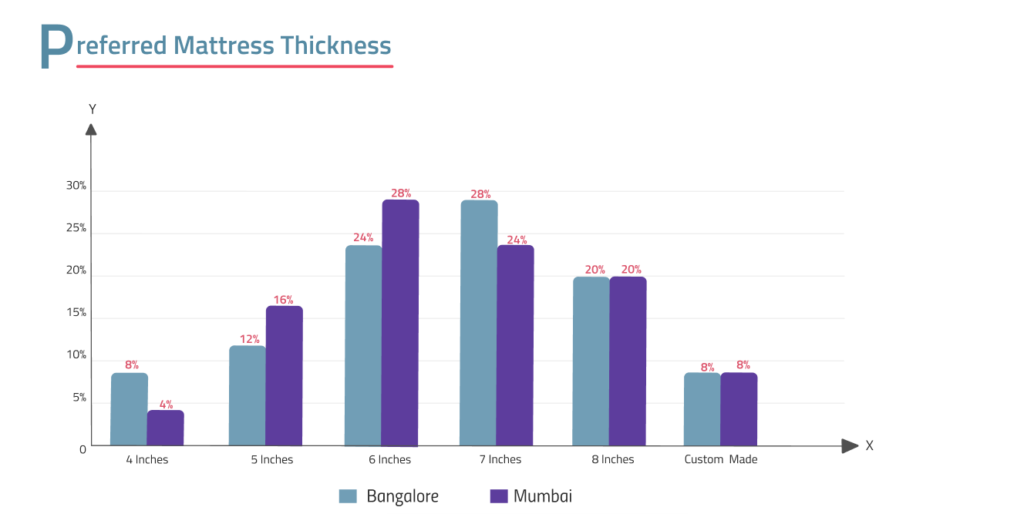

- Thickness : Preferences varied, with 6 to 8 inches being the most commonly selected.

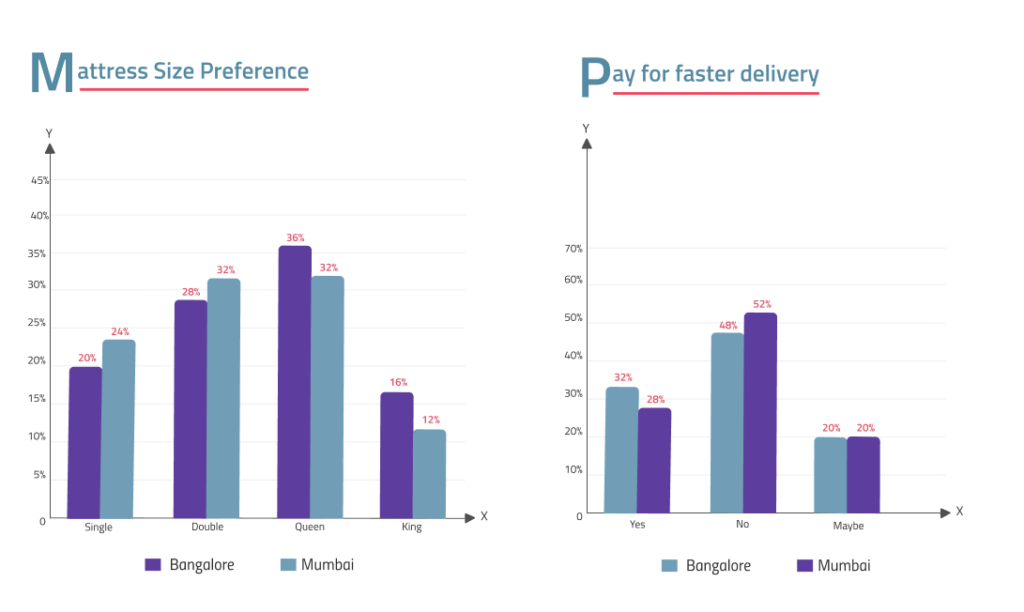

- Size : Queen size emerged as the most popular, followed by double and king.

- Material & Feel : Bangalore respondents leaned toward foam + spring mattresses, while Mumbai consumers favored coir + foam for its firmness and breathability.

Marketing Preferences

Email remains the most accepted channel for receiving updates and offers, followed by WhatsApp.

Recommendations

- Based on the survey insights from Bangalore and Mumbai, the following recommendations are proposed for mattress brands targeting urban consumers

- Prioritize Comfort and Health Features : Focus on mattresses with orthopedic support, cooling technology, and hypoallergenic materials, as these are highly valued by health-conscious consumers.

- Offer Thickness and Size Variants : Provide multiple options in the 6–8 inch range, and emphasize queen and double sizes, which are the most preferred in urban households.

Recommendations

Promote Smart Packaging and Timely Delivery

Highlight rolled, vacuum-packed delivery options and aim for a 2–3 day delivery window. Fast delivery should be optional rather than standard, given the low willingness to pay extra.

Leverage Digital Channels for Engagement

Focus on email and WhatsApp to share promotions and product updates, tailoring messaging to highlight value and comfort.

Customize for Climate and Lifestyle

In humid regions like Mumbai, promote coir-based options for breathability; in Bangalore, highlight foam + spring combinations for enhanced comfort.