The Indian mattress industry is on an aggressive growth path with organized players collectively trying to increase their combined market share with better-quality adhesives brands. Indian consumers are getting health conscious and turning their heads towards innovative and quality-oriented mattress brands, as figured out by a Mordor Intelligence report that states, “Rise in income levels and health consciousness and growth in the real estate and hospitality sectors are major factors that accelerated the growth of the Indian mattress market.”

As we witness a shift in consumer mindset, which is now focussed more on quality than price, it is imperative to discuss what goes behind making these innovative and comfortable mattresses. Adhesives or glues that fix various layers of foams that go into making a mattress hold most of the responsibility when it comes to determining the quality of a mattress or other sleep products.

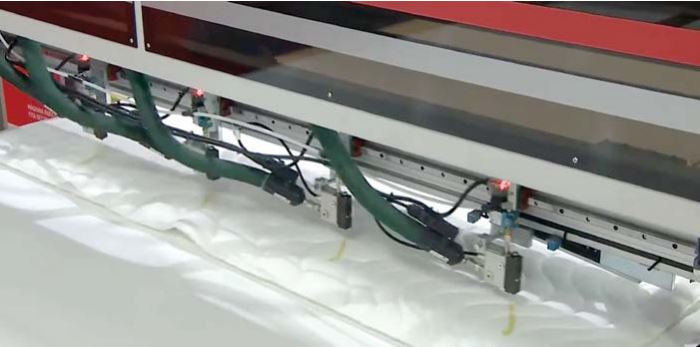

The mattress and the bed-making industry is dependent on good quality adhesives to deliver a good mattress. Consumers are increasingly demanding mattresses that suit all their health and comfort requirements. Mattress manufacturers are using multiple layers of foams, cotton, wool, synthetic rubber, polyester, latex etc. to design better sleep products. They are responsible for fixing up different layers of foams and raw materials and hence play a very crucial role for mattress manufacturers to bring more innovation to their products.

For innovation to happen in the mattress industry the need for efficient adhesive solutions is paramount. The mattress adhesives market is offering sustainable solutions like solvent-based, waterborne mattresses and hotmelt adhesives. These solutions ensure that the finished sleep products are long-lasting, well-ventilated, Transported-friendly and come with easy maintenance.

Besides that, Such companies have to come up with solutions that not only hold all raw materials firmly but also help mattress makers move their products rapidly off the production line and help them pack and deliver the sleep products well on time to the customer. Such companies are coming up with a solution that helps mattress companies meet the growing demand on time.

Before we delve deep into how such companies are addressing the current needs of mattress makers, it would be interesting to know how the importance of adhesive has increased among mattress manufacturers over some time.

History of adhesive usage in the Indian mattress industry

Despite all efforts by the Indian mattress makers, a large pie of the domestic mattress market is still dominated by unorganized players. The concept of mattresses did not exist until the 1960s. People would either sleep on handmade cots or mats. The first set of mattresses was stitched by local ginners who used cotton fills, feathers and other available raw materials. In 1960, rubberised coir mattresses were introduced and they used latex as adhesives.

Adhesives contribute to the safety, quality, and sustainability of mattresses

The usage of latex as adhesives prevailed from 1960 to the 1980s. After this period there was an increase in the cost of latex. As it piled on the manufacturing costs, mattress makers looked for a substitute and that is how adhesives were used in mattresses.

“The latex rubber itself was used as adhesives. However, over some time, the cost of latex went up by 300 per cent and hence, there was a need for its substitute. That is how mattress makers resorted to adhesives to produce mattresses, explains S Sundaresan, Secretary, of the Indian Sleep Products Federation (ISPF).

Now, different types of adhesives serve different purposes. Mattress manufacturers need to asses their requirements and decide on the right kind of adhesives that will help them fix different layers of mattress substrates while ensuring that the final product is versatile and user-friendly.

Latest types of adhesives used in the mattress manufacturing

Various types of adhesives are used by various mattress manufacturers. Each type of adhesive has its unique properties and the manufacturers first need to asses their key requirements before deciding on the right set of adhesives. The most common types of adhesives are broadly classified into Water-based, Solvent and Hot melt adhesives

- Water-based adhesives: They are used by companies that are into manufacturing natural mattresses. Water-based adhesives take more time to bind different layers of a mattress and therefore, their manufacturing process is time-consuming i.e. it takes close to 45 mins to dry. However, these are safe, sustainable, non-toxic, odourless and environment friendly.

- Solvent-based adhesives: These are quite strong and can bind different layers of mattresses for longer years. However, they are not sustainable and environment friendly as they may off-gas harmful materials as soon as the glue evaporates. With the advent of technology, the usage of solvent-based adhesives in mattresses has become minimal these days. Mattress manufacturers are now able to manufacture bigger solid pieces that allow companies to apply lesser amounts of adhesives.

- Hot melt adhesives: As its name suggests, they are applied using hot air and it sets as the heat subsides. It doesn’t contain solvents and the biggest demerit of hot melt adhesives is it creates a cracking noise as soon as it cool down and gets dry. However, their makers are working on ways to eliminate this noise.

The Indian adhesives and sealants market is expected to grow, driven by the demand from the foam and mattress industry

Each mattress adhesive has its own set of pros and cons. To choose the right mattress adhesive, mattress manufacturers have to assess their specific requirements. While explaining different types of mattress adhesives, Ashok Narayan, Sales and Marketing at Pidilite Industries Ltd. said, “Water-based adhesives offer a deeper and more flexible mechanical bond compared to hot-melt adhesives. This makes them ideal for applications that require a strong and long-lasting bond, such as in the case of foam-to-foam and foam-to-fabric mattress components. However, water-based adhesives are slower to dry than hot-melt adhesives, which can be a consideration for manufacturers operating in a fast-paced production environment. Pressure Sensitive Hot-melt adhesives, on the other hand, are extremely fast setting and provide a tacky glue line. Hot-melt adhesives may not also provide the same level of deep mechanical bond in comparison with water-based adhesives.”

If we go by a Fact.MR reports that water-based foam adhesive will dominate the foam adhesive market. As the demand for mattresses is on the rise, manufacturers demand more adhesives to keep the production process running. The fast-curing water-based foam adhesives result in instant settings and reduce mattress manufacturer’s production time. These adhesives are both safe and user-friendly and ensure good-quality for mattresses. They shape bonds that ensure more versatility in a sleep product and the ideal trait of water-based foam adhesives is, that they emit no odour.

Current contribution of adhesives in mattress industry

The adhesive industry is primarily classified into two segments, namely, Industrial adhesives and Consumer adhesives. The Consumer adhesives segment has its applications in the furniture, building and construction, electricals and electronics and in the foam and mattress industries. If we narrow down our focus to the Indian mattress industry, a CRISIL report explains that 8 percent of the consumer adhesive segment in India is commanded by the foam and mattress segment.

The CRISIL report also states that India’s consumer adhesives industry is likely to clock a 9-10 percent CAGR between fiscal 2021 and 2026 driven by economic recovery and growth in end-user industries. Overall, growth of the consumer adhesives industry is expected to moderate and log a CAGR of ~8 percent between fiscal 2022 and 2026. The growth figures look convincing as consumer adhesives are being used for endless applications. As far as the domestic mattress industry is concerned, the demand for adhesives is going to increase with the growth of the organised sector. Growing awareness about health among people,

increasing demand from the hospitality and healthcare sector and rising disposable income among people are going to drive the growth of the organized sector of the mattress industry. To meet this growing demand for mattresses, manufacturers will demand more adhesives to keep their production line moving at an efficient pace.

Some of the key players in the adhesive segment that manufacture such products that suit the requirements of the mattress industry include Pidilite, Astral Adhesives, and Atlas Adhesives to name a few. Pidilite is a leader provider for mattress adhesives and the company is constantly trying to work on better technologies to make their product more conducive for the mattress manufacturers.

“Our new range of adhesives features ultra-high solids, which provides a host of advantages over traditional solvent-based adhesives. This includes improved mileage, faster drying times and compatibility with a wide variety of substrates while using solvents that are compliant with the regulatory framework. In addition to the launch of our new solvent-based adhesives, we are also exploring new technologies and materials that can help to further enhance the performance, efficiency and safety of our products, explains Narayan of Pidilite.

Contribution towards safety measures of a mattress

Water-based, solvent-based and hot melt adhesives have not only helped mattress manufacturers maintain a price advantage but have also contributed a lot towards making mattresses safer. Most mattresses use a variety of adhesives during the production process to improve the overall quality of mattresses.

The adhesive industry is primarily classified into two segments, namely, Industrial adhesives and consumer adhesives. The consumer adhesives segment has its applications in the furniture, building and construction, electricals and electronics and in the foam and mattress industries.

Adhesive companies are constantly innovating their products to make them safer for the end users. Adhesive makers are focussing on making chemical-free adhesives that do not off gas harmful chemicals through the mattress substrates. They are increasingly using low-hazard organic solvents to ensure maximum safety for mattresses during the production process and the storage and warehousing phase. “Fire Hazard is a common problem in the mattress industry and maximum risk is posed by the use of the traditional adhesives and our newer offerings eliminate this risk,” said Narayan of Pidilite.

Mattress market players are increasingly demanding non-hazardous, green and sustainable adhesives. As figured out by CRISIL, demand for bio-based / green adhesives, such as starch and lignin, is increasing rapidly, as consumers are starting to realise the adverse effects of petroleum-based products. Consequently, manufacturers are spending huge amounts of capital on the research and development of such adhesives. Currently, hybrid adhesives are being increasingly used by end-user industries of adhesives, as they are considered to be green and sustainable alternatives for solvent-based adhesives.

The need to ensure safety in mattresses is quintessential and a top priority among adhesive makers as mattress manufacturers are too vigilant about what goes into making their mattresses. “The latex we use for our manufacturing is GOLS (Global Organic Latex Standard) certified Natural Rubber Latex as the base polymer. It ensures social and environmental conformity. Good quality branded chemicals of Accelerators and Antioxidants give a long-lasting product,” says Thomas Varghese, General Manager at MM Rubber Company Ltd.

Besides that, consumers are also thoroughly researching mattresses or sleep products before investing in one. Other than quality and comfort, consumers are also prioritising sustainability before buying a sleep product. They are even interested in the quality of adhesives that have gone into making mattresses. Is the material used in the mattress eco-friendly, sustainable and fireproof? These are some hard questions that consumers ask before buying a mattress. Needless to say, with increasing income levels and health consciousness, their demand for more and more sustainable products will only increase. To cater to a bigger market, mattress makers have to offer different types of mattresses at different price points while maintaining the quality and sustainability of the product.

The close relationship between the adhesive and mattress industries can lead to further innovation and advancements in both sectors

The road ahead

Before analysing the future of adhesives in the Indian Mattress industry, let’s analyse the overall adhesives industry both at the global and Indian levels. The global adhesives and sealants market size was valued at USD 67.48 billion in 2022 and is expected to register a compound annual growth rate (CAGR) of 6 percent from 2023 to 2030, according to Grand View Research.

The report further mentions Asia Pacific region dominated the market with a revenue share of 41.2 percent in 2022. The COVID-19 pandemic created a sizable impact on various industries such as textile & garments, construction, and automotive in 2020, wherein export trade was also primarily impacted. For instance, as per the government data, the textile trade between China and India observed a year-on-year decline of 12.4 percent in the first 2 months of 2020 from the previous year. The market has shown a positive recovery since the third quarter of 2020 and gained momentum during 2021.

According to market research firm market research. com, The Indian adhesives and sealants market is projected to reach USD 1,703.68 million by 2026, growing at an estimated CAGR of 8.07 percent over the forecast period (2021-2026). India’s adhesives and sealants market is highly concentrated in terms of revenue. The top five players account for a combined share of more than 90 percent, thus making the market highly competitive. Pidilite Industries Limited is the market leader in the India Adhesives and sealants industry with a share of almost 48 percent, thus continuing its dominant position for the past few years. Other major companies include Henkel Adhesives Technologies India Private Limited, Sika AG, Arkema Group, and H.B. Fuller Company, amongst others, outlines the report.

We are considering all these facts and numbers into account if we further narrow down to a Fact.MR reports, that there is a huge demand for mattress and pillow manufacturing that will be one of the key growth drivers for the foam adhesive segment. Between FY’15 to FY’20, the Indian adhesives market recorded a stagnant growth rate and recorded a CAGR of 7.5 percent, points out a Ken Research report.

The market research firm mentions the surging demand for water-based adhesives in India is contributing to the growth of this industry in India. Besides that, Government initiatives such as Make in India and Smart Cities projects are contributing to their market growth.

Furthermore, Global companies are expanding their presence to target a larger target audience across India. The consumer adhesive companies in India will continue to expand their dealer and distribution network to reach a larger target market which would help them increase their market share, assures Ken Research.

Going ahead, the Adhesives and Sealant industry is going to witness more growth, innovation and widespread reach. For this purpose, The Adhesives and Sealants Association (TASA) was formed in 2010 to cater to the needs of this particular industry in India. TASA aims to promote the Adhesives and Sealant industry by disseminating the required knowledge to the stakeholders of this industry and bringing in advanced technologies in India that are sustainable and environment friendly.

As the Indian mattress industry grows, the demand for adhesives will also rise. The mattress industry which currently contributes 8 percent to the entire consumer adhesive segment is set to ask for more share in the domestic adhesive industry.

This can be achieved by bringing in more innovation in the mattress segment. The mattress and the adhesive industry could have a symbiotic relationship. Innovation in the adhesive industry could help mattress manufacturers come up with new and better concepts in the sleep industry and vice versa.

As the Indian mattress industry is aggressively trying to capture a bigger market size by selling the idea of ‘Sleep for overall well-being’, demand for more adhesives (in terms of volume, quality and sustainability) is only going to increase. Besides that, the growing omnichannel presence of established and new brands will get more buyers for safe, comfortable and sustainable mattresses. Adhesive companies must get ready to cater to this likely demand from the mattress industry.