From the lipstick effect of economic slowdown to its ties with the housing market to its turbulence in the wake of trade wars – economic changes and mattresses are not as isolated as one may assume them to be – let’s understand where and how one affects the other and vice versa.

The trend was discovered in the early 1930s when consumers indulged and increased their spending on small, affordable luxuries despite economic hardship.

“In the years 1929 to 1933, despite industrial production halving, sales of cosmetics actually rose in the United States,” The New Daily quotes Dr Louise Grimmer, a University of Tasmania marketing lecturer.

In a similar play, just after 9/11, Estee Lauder reported a spike in their relatively expensive lipstick products.

Australia has reported a spike in hospitality spending through April (2019) which is also attributed to this effect. Despite a constant stream of bad economic news, Australians’ appetite for eating out has been unabated. It’s the ‘lipstick effect’ in action.

When Union Minister Ravi Shankar Prasad cited the Rs 120 crore business done by three Bollywood movies in a single day to suggest strength in the fundamentals of the Indian economy later on only to retract his statement, it was the lipstick effect in action. The Indian economy has seen similar sentiments playing in ultra-luxury housing, gold, gadgets during Diwali and high-end automobiles. Though muted, the hum is visible.

What went wrong In the beginning, everything was humming at top gear. Up until 2017, things were looking so good that economic watch agencies around the world, decided that India was on a historic growth trajectory and would outpace China in the near future.

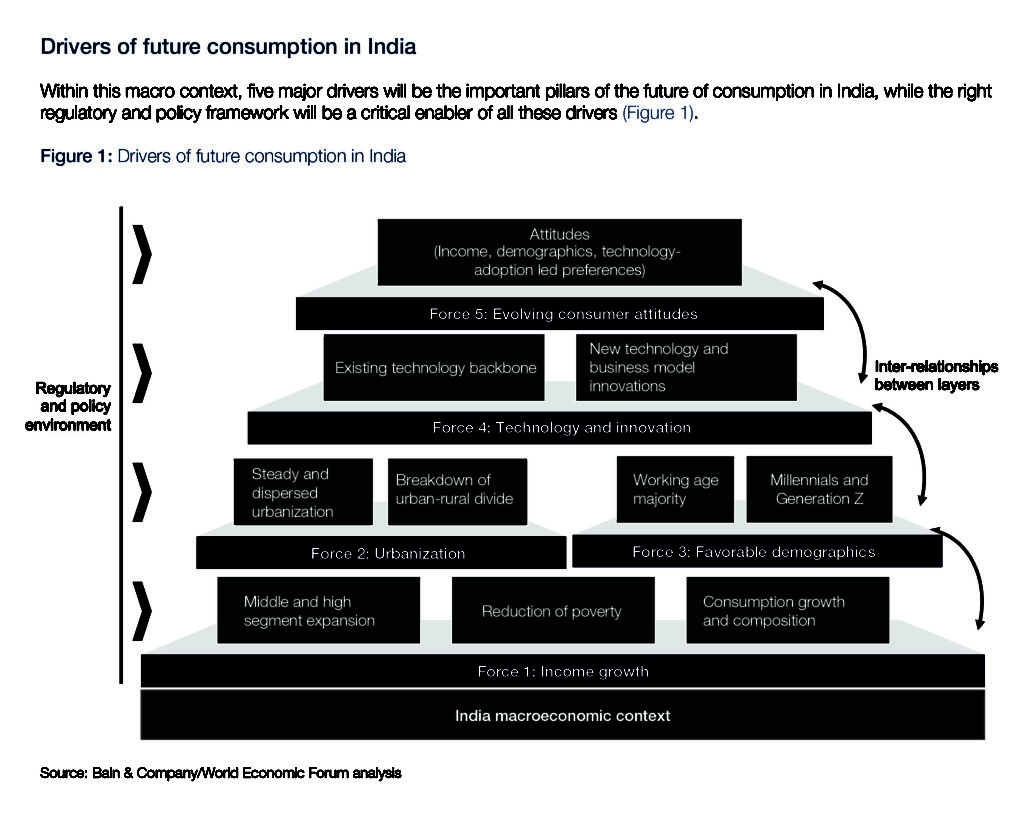

Here is how the World Economic Forum saw it coming, riding on a 5-Factor growth engine starting with basic income growth, urbanization, and favourable up-worldly mobile demographics, technological innovations and evolving consumer attitudes.

Yet, like all crystal ball gazers, none saw that India’s economy was getting more and more connected to the global economy and a sneeze in Brazil may result in a tsunami in India. That’s just what seems to have happened. With the global economy in a stagflation situation, the US-China Trade War becoming more and more ominous, Europe in the grip of a bear hug and U.S. economy never recovering fully from the 2008 housing loan bust, and India’s consumption demand has fallen. Geo-political situations have also contributed to this factor. Capital formation has become a challenge. And our economy is looking far from healthy at this point.

Just How Did We Get to an Economic Slowdown?

Business Activity India’s private sector seems to be sliding down the ramp from July 2019 reflecting a general economic slowdown in new business. The sluggishness in both manufacturing and services activity as reflected in the Business Standard’s (BS) survey of Purchasing Managers, shows a fall in the composite index to 52.6 in August from 53.9 in July.

While input prices for services and the manufacturing sector rose during the month, manufacturers refrained from passing on costs amid efforts to boost sales, reports BS.

Exports

Exports data point to a 6.1 percent slump in August as previous earlier, which had marginally risen 2.3 percent in July, attributing the decline to an adverse global trading environment, and base effects. Meanwhile, imports were dragged down by weak domestic demand which, in reality, helped to keep the trade gap broadly unmoved compared to the previous month.

Consumer Spending

Consumer spending was low, including in rural areas. That supports a recent report by Nielsen, a market researcher, that lowered its 2019 growth forecast for the fast-moving consumer goods sector to 9-10 per cent from an earlier estimate of 11-12 percent, says Business Standard.

Urban consumers seem to have contributed majorly by curtailing spending, due to the looming growth slowdown and fear of job losses.

Naturally, the same sentiment seems to have weighed on demand for loans, with overall credit growth reaching 10.3 percent in August down from 14.2 percent in April, according to Reserve Bank of India data.

The Citi India Financial Conditions Index, a liquidity indicator, showed overall conditions grimmer.

Industrial Activity

India’s core infrastructure industries’ output, which constitutes 40 percent of total industrial production, grew 2.1 percent in July from a year ago. The data offered mixed cues, with moderately healthy growth in cement and steel offsetting a contraction in coal, crude oil, natural gas and refinery output.

Industrial output growth accelerated to 4.3 percent in July from 1.2 percent in June. While the headline number showed a bounce, the production of capital goods — an important indicator of future demand — contracted for a third straight month. Both the core sector and industrial output numbers are reported with a one-month lag.

So is that it? Am I to worry now?

No, do not worry, hope is at hand. Every market segment has shown a streak of “lipstick effect” in its own way. Let’s look at some of the key ones relevant to the sleep industry.

Realty Registers

Hope the Real estate sector, hit by new regulations and unable to cope with demonetization, has been reeling under a long-drawn crisis. Stressed realtors, projects in limbo and poor home buyer demand have made things tough. But green shoots are sprouting in some pockets.

Just consider this. In 2016, DLF Ltd announced that it would depart from the industry norm and complete a residential project before selling it. Today, its Ultima project in New Gurugram has sold 376 ready-to-move-in apartments worth Rs 700 crore. This strategy is helping instil confidence in the market.

Anuj Puri, chairman of Anarock Property Consultants, says that it is also a matter of getting the price-location equation right. “In Dombivali, Mumbai, Runwal Properties sold 280 apartments in three days. We were zapped by such outstanding success. Conversion of footfalls have risen from around 8-10 percent earlier to now around 17 percent,” Puri says.

Office real estate is seeing good demand. For one, office REITs (real estate investment trust) is bringing some cheer to the real estate sector. Embassy Office Parks REIT (launched with Blackstone) has given over 20 percent return since its listing in April.

Encouraged, other developers like the Rahejas and Prestige Group are also considering launching REITs.

Despite hiccups, the government’s Pradhan Mantri Awas Yojana (PMAY), which targets to build 20 million affordable houses for the poor by March 31, 2022, is progressing well. As part of PMAY (Urban), against the target of 1.12 crore, 90 lakh houses have already been sanctioned. “This has attracted good investors like HDFC and Abu Dhabi Investment Authority. Finally, we seem to be making progress in affordable housing,” says Srivastava.

The travel and hospitality industry is regaining its vitality in small measures. This has a direct correlation to the sleep industry. The home refurbishing market is seeing some thaw. A good mattress at home, a cosy branded bedlinen and bed fabric is everyone’s dream. Show them a good product and they will set their mind to it. Come up with the right pricing and payment options you will have a “lipstick” effect kicking for your industry.

So, What Is this Lipstick Effect?

The lipstick effect is when consumers still spend money on small indulgences during recessions, economic slowdown, or when they have little cash. They do not have enough to spend on big-ticket luxury items; however, most still find the cash to purchase small luxury items, such as premium lipstick. For this reason, companies that benefit from the lipstick effect tend to be resilient even during economic slowdown.

The lipstick effect is one of the reasons that fast-casual restaurants and movie screens typically do well amid recessions and explains why Bollywood still does well despite an economic slowdown. Cash-strapped consumers want to treat themselves to something that helps them forget their financial problems. They can’t afford to escape to Mauritius. However, they’ll settle for a fairly cheap night out and a movie, or sleep in a cosy bed, adjusting their budget accordingly.

Just do a quick check if you can appeal to the consumer to kick in a lipstick effect.